Whilst the education sector is not immune to the impact of the economic downturn, it is bucking the downward trends that are currently the norm in other sectors of the electronics market. One of the key reasons is that there are often strong political/economic motivators for governments to invest in technology in the classroom. Firstly, many governments are seeking to invest in the IT capabilities of the workforce and introducing technology into learning is one way of doing this. Secondly, investing in education is a clear political vote winner and for these two reasons it is possible that investment in education can in some instances continue in austere economic times.

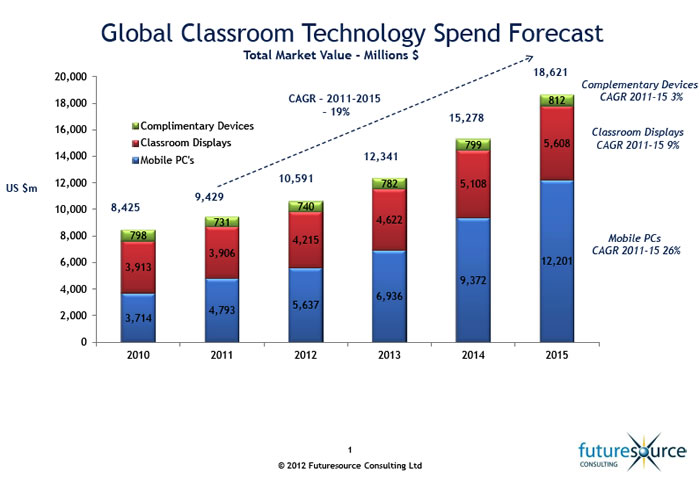

A great example of this is the multi billion $ FATIH project currently underway in Turkey. The Turkish government is seeking to revolutionise learning and in addition invest in the Turkish manufacturing industry. As part of the project the government plans to install 65″ interactive displays in every classroom (circa 600 to 900k) and in addition provide tablets to every student (over 12 million). Interest in one-to-one learning via tablets/notebooks continues to develop at pace globally. As the concept of ‘self-paced’ learning develops, global sales of mobile PC’s (notebooks, netbooks, tablets) into K-12 education are expected to reach 15.6 million units in 2012 with Ipad deployments developing rapidly in the US especially. Key to the adoption of ‘one to one’ learning will be the speed in which the multimillion dollar academic book sector transitions to digital. Many governments are actively seeking to develop their in-school infrastructures (i.e. broadband connectivity, content strategies) with this in mind.

It is often cited that budgets in the education sector are limited and certainly it is not possible (both structurally and financially) for many countries to behave like Turkey. Governments and schools are becoming increasingly creative when seeking to fund technology purchases. We have seen an increased trend in schools asking parents to contribute towards device ownership, either through leasing or part payments. As one-to-one learning initiatives roll out globally we also see commercial entities developing partnerships with government.

Telecommunication companies especially have a lot to gain from widespread ‘one to one’ usage. In Portugal a nationwide ‘one-to-one’ programme took place, with telecommunication companies working with the government. Every student in compulsory education (1.8 million) received a netbook (part funded originally by the Telcos) and in return parents had to sign up to three year discounted broadband contracts. These kind of ‘win-win’ deals are likely to become more commonplace, together with leasing programmes as schools and governments seek affordable and practical ways to develop one to one learning.

With the digitisation of education continuing at pace, interesting new revenue streams could open up for providers. Innovative companies are beginning to target the multi billion dollar tutoring market with digital solutions (streamed lectures, group/one to one tutoring etc) and it is these types of ancillary revenues that are likely drive market developments in the future.

The market for IT hardware in education is complex with each country, and in many cases each state or region, behaving very differently. The flow of money clearly has a major part to play in the adoption of IT hardware but even this area is subject to a number of different influences. It is clear that there are significant growth opportunities for the sales of IT hardware in the education sector but the challenge for suppliers is to understand what product solutions and partners will be required to secure longer term success.

Mike can be contacted on mike.fisher@futuresource-hq.com

Futuresource Conferences @ CEATEC JAPAN 2012 are planned as below.

Wednesday 3rd October 2012 [Room 201A]

(English with Japanese simultaneous interpretation)

- [IB-07A] 14:00 – 15:00 Global Consumer Electronics Industry Outlook

- Who will benefit from this session:

- Manufacturers, Vendors, retailers and distributors, and associated component suppliers and associations from the following industries:

・ Consumer AV Electronics; Imaging; Computer (including Tablet); Mobile communications; Games Industry

- Entertainment content owners, software and platform operators and media companies will benefit from this presentation.

- [IB-08A] 15:30 – 16:30 The Education Sector – The Next Big Opportunity For the CE Industry?

- Who will benefit from this session:

- Manufacturers, vendors, retailers and distributors, and associated component suppliers and associations from the following industries:

・ Education specialist providers, Display providers, Consumer Electronics; Computer (including Tablet); Mobile communications; Games Industry

- Also content owners, software and platform operators, and media companies in general will benefit from this presentation.