The global home entertainment sector, both hardware and content, remains fairly resilient in times of economic downturn, and although 2011 was a challenging year it would appear that the industry fared better than many others.

TV sales were slightly down, but tablets, Blu-ray players and smartphones all recorded healthy sales increases.

On the content side, spend on physical media was down around 5% while spend on online viewing grew by more than one third – although being such a small part of the overall total, this increase was not enough to generate overall growth.

The full story is not so much about the amount consumers spend on accessing entertainment content, it’s much more about the dramatic changes that are taking place in the ‘how’, ‘where’ and ‘when’ that entertainment is consumed.

Recognising that consumer behaviour is changing at an accelerated pace, driven by new hardware, new service offerings and widescale connectivity, Futuresource conducts regular tracking research to monitor consumer attitudes and behaviour across the USA, UK, France and Germany.

The key driver for this change in behaviour is the growing number of Internet connected devices owned by the consumer – and increasingly they do not want to be inhibited by using just one device at a time. Mobile phones and tablets have clearly been a big influence here but laptops and other PC configurations also contribute.

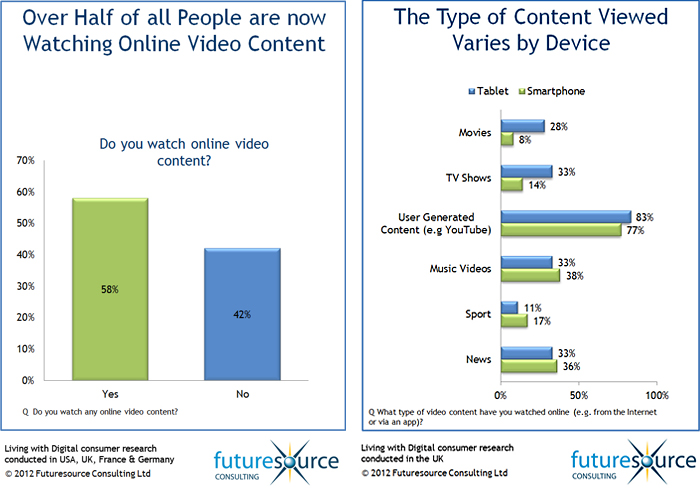

One of the strongest messages emphasised by recent Futuresource research is the fact that more than half of all UK consumers now watch some form of video content online, with more than one quarter using their mobile phone for video viewing, at least occasionally.

User generated (e.g. YouTube) is the most popular type of content viewed across all connected devices. Movies and TV shows are also popular among tablet users whereas music videos, news and sports are more popular among smartphone users.

When asked why people are watching so much content online, respondents cited “wider choice of content” and “viewing flexibility” among the main reasons. The BBC iPlayer is clearly driving a lot of this flexibility, along with SkyGo, which is also contributing to the growing consumer interest in viewing on mobile and handheld devices.

The emergence of connected TVs now brings online content to the large screen, thus overcoming one of the most frequently cited barriers to the growth of online content services. Driven by popular apps, connected TV usage is generating even more traffic for the iPlayer, with close to 60% of connected TV users accessing ‘catch-up’ BBC content.

Second screen is the focus of much industry attention right now – whereby consumers are effectively viewing more than one screen at a time – watching a movie on the TV while accessing Facebook or the sporting highlights on an iPad, phone or laptop. Close to half of all respondents acknowledged using another device with a screen while watching TV, primarily to prevent boredom. Interestingly, there is a small but significant element (10%) that uses a second device because they like to feel part of the programme they are watching, indicating that programmes using live voting and social networking connections may be gaining some traction.

Interest in video entertainment in all its forms and genres is increasing, boosted by increased flexibility. The ownership of more connected devices is opening up more opportunities to view. This, in turn, is boosting demand for online video services, including catch-up TV. Competition for consumer eyeballs at home and on the move is at an all time high.

A combination of the second screen, hard disk drive usage and catch up TV viewing will mean that advertisers will have to be increasingly creative to get the attention of viewers.