London, 05 January 2012 – Futuresource Consulting has released a strategic research report focusing on the opportunities for personal computer devices within the K-12 education sector, showing a compound annual growth rate (CAGR) of 28% for 2011 to 2016.

As the global PC market continues to flatten off and revenue streams within enterprise and consumer segments become harder to sustain, the education sector is bucking the trend and opening up new areas of opportunity for vendors and component suppliers alike.

“There is no doubt that education is undergoing profound change in many countries across the globe, with the adoption of ICT as a learning tool forming the nucleus of this change,” says Mike Fisher, Convergence and New Technologies Consultant, Futuresource Consulting. “From providing a richer, tailored learning environment to allowing students to study at their own pace, many governments are not only recognizing the benefits of ICT in the classroom, but are also going to great lengths to make sure 1:1 learning programmes are rolled out. The proven vote winning power of investment in education combined with declining prices and increased product customisation is developing considerable market demand. And with nearly 1.4 billion enrolled students and teachers across the world, this clearly represents a significant opportunity for vendors.”

In addition to hardware supply, the content and delivery infrastructures are vital to an effective and successful rollout. As a result, telecommunications companies have become increasingly involved in technology deployments into education. Their role can be seen in various elements of projects, from funding and financial contributions to networking the devices or distributing hardware and content. These companies have a keen interest in being involved, as an increasingly IT-dependent student population will naturally result in increased content consumption in the long term. As a result, the telecommunications industry is – and will continue to be – a major source of non-governmental funding.

Futuresource research shows that global PC shipments into education exceeded 11 million units in 2011, with a significant amount of activity taking place in Central and South America.

“A number of substantial nationwide rollouts took place last year,” says Fisher. “In Argentina, the Conectar Igualdad project reached its stage two goal by mid-2011, deploying 1.2 million devices across the country. Preparations are now being made for the final stage, which should see similar numbers deployed in 2012. Over the border in Uruguay, the Plan Ceibal project now has 100% ICT penetration in primary schools and is expected to get close to 100% penetration in secondary schools in 2012.”

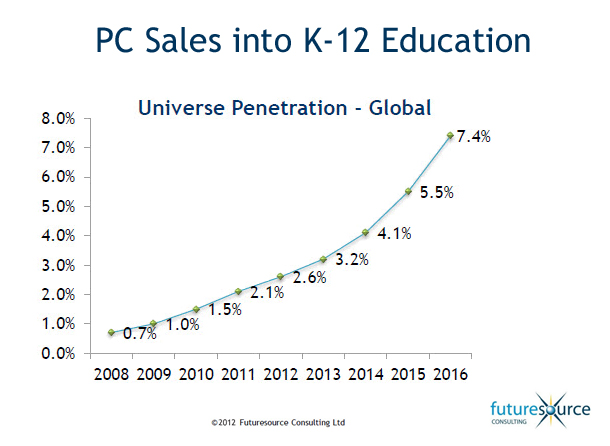

With strong expectations of multiple government tenders during 2012 and beyond, Futuresource forecasts indicate large sales volumes across many territories, with global shipments reaching close to 12 million units in 2012, rising to over 40 million units by 2016, though the installed base will still represent less than 8% penetration in 2016.

Potential market entrants need to tailor their strategies to the different decision making hierarchies, purchase responsibilities and power bases that define each country.

“We’ve been tracking education markets for more than ten years and it is clear that there is little correlation between a region’s economic prosperity and the investment in school spending,” says Joe Mugan, Market Analyst, Futuresource Consulting. “The key determining factor is government support for ICT usage in the classroom, often driven by the positive messages that this sends out to the electorate. However, many large and financially established countries – such as Germany and Japan – have concentrated on traditional teaching methods and as a consequence technology adoption in schools has remained relatively low. The interest is coming from elsewhere: the areas to watch this year include Turkey, Thailand and the Middle East, where multi-billion dollar nationwide tenders are likely to be initiated.”

“The speed of market rollout is dependent on the complexity of the decision making structure in each country. Widespread and rapid adoption of ICT is typically easiest when budgeting is carried out centrally, although there are huge opportunities for vendors regardless of a country’s governmental structure, as long as a vendor’s resources are focused on the right target at the right time, with strategies optimized to the nuances of the country. Make no mistake, once a government decides to invest in education, the implementation can be fast and the expenditure enormous.”