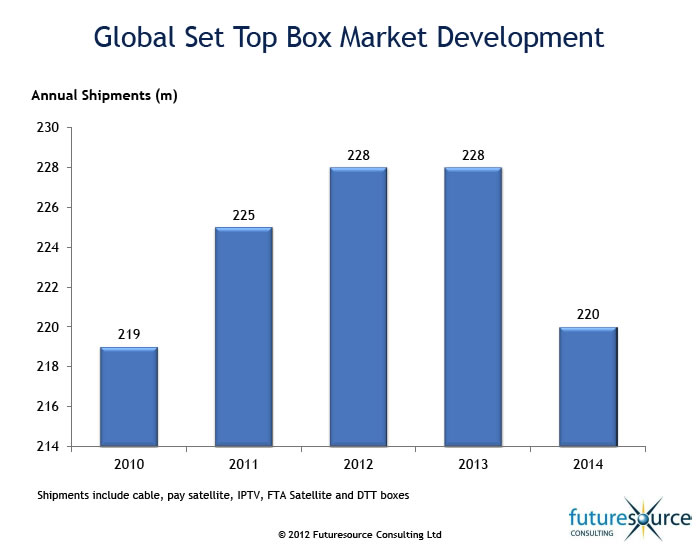

Following several years of healthy growth, demand for set top boxes (STBs) continues to climb this year, on track to reach 228 million units shipped globally, according to a new report from Futuresource Consulting. However, as demand from maturing pay-TV markets like North America and Western Europe begin to slow, the market will start to see moderate decline over the next few years.

STBs will remain a core component of a pay-TV operator’s proposition given the vast installed base. There will be sufficient demand throughout the forecast period to 2015 and beyond to provide a solid platform for the launch of new services and improving customer loyalty by offering additional features such as on-demand and recording capabilities. The ongoing conversion of analogue subscribers to digital services and the growing Asia Pacific and Latin American markets will also maintain demand.

Looking to the hardware, a number of manufacturers have launched new generation STBs labelled as media gateways or smart boxes, offering many additional premium features <<

Many mature pay-TV markets are experiencing a decline in video-related revenues, so operators are turning to new services to stimulate growth. The development of exciting new additions, which include home management, security, gaming and health monitoring are all being rolled out, made possible by advanced features inherent in new generation STBs.

In Western Europe, digital cable homes will rise by 13.5 million by 2015, with the majority of growth triggered by the conversion from analogue to digital. However, total cable households in this region will reduce throughout the forecast period. This comes as significant numbers of analogue subscribers transfer to free to air services and alternative pay-TV platforms. Increased premium video services and higher value broadband packages are driving growth across maturing markets.

In North America, digital cable households rose 4% between 2010 and 2011. However, this growth was offset by a 25% decline in analogue homes. Despite an expected decline in total cable homes throughout the forecast period, total digital homes will increase albeit at a slowing rate.

The saturation of cable operators’ existing services has resulted in the development of several key non-video related services including home networking infrastructure and compatibility with portable devices allowing access to in-home lighting, temperature and security. Such offerings are expected to become increasingly widespread due to the competitive nature of the market and slowing revenues forcing operators to embrace new growth opportunities.