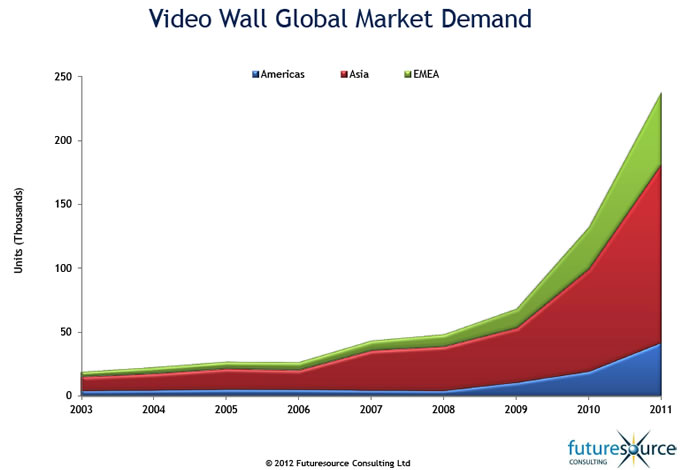

The global video wall industry is experiencing renewed growth, with the market on track to reach 380,000 unit sales in 2012, equating to year-on-year growth of 60%, according to a new industry report from Futuresource Consulting.

“Recent innovations have breathed new life into this relatively mature industry,” says Parmjit Bhangal, Market Analyst, Futuresource Consulting. “Since 2009, LED backlight solutions have been used in rear projection displays, removing the costs of bulb replacement and maintenance. However, LCD super narrow bezel displays – SNBs – have been the real game-changer, finally offering a suitable alternative to rear projection devices and plasma screens, allowing vendors to drive new revenue streams from new markets, most notably retail and public display.

“These technological advancements have created a huge amount of industry buzz, dominating trade show floors and commanding the interest of industry press, and we’re seeing all this potential start to convert into revenues. Last year, the SNB category posted year-on-year sales growth in excess of 100% and accounted for over 80% of the total video wall market.”

Yet despite the competition from SNB displays, the rear projection category continues to grow steadily, with Futuresource forecasts showing that growth will continue out to 2015 and beyond. The introduction of solid state technology has been key, with LED accounting for nearly 40% of sales in 2011, though this figure would be far higher if China – a huge lamp-based market – was excluded from the analysis.

There are four key markets for video walls: control room; retail and public display; corporate and exhibition; and broadcast.

- Control room is a key market for rear projection displays, accounting for more than 85% of global sales last year and also seeing growing demand for SNB. The choice of technology depends on the area, with utilities and command and control tending to favour rear projection, whereas the video-based applications of surveillance and traffic management favour SNB.

- Retail and public display are both dominated by SNB and accounted for the majority of SNB sales last year. Digital signage is a key driver for growth in this category as network owners look to create high impact displays to inform, communicate and advertise to customers. Retail and Transport sub-verticals are both key adoption areas.

- Corporate and exhibition verticals both provide growth for rear projection, though SNB is clearly the dominant technology. Reception areas, lobbies, boardrooms and exhibition are all important drivers.

- The broadcast space still requires both rear projection and SNB products. Rear projection is heavily skewed towards the Asia Pacific region, though still has relevance in developed markets.

“Market dynamics differ significantly from country to country, with investment in infrastructure often a key driver for both display technologies,” says Bhangal. “Moving forward, we’re going to see strong double digit growth over the next three years, reaching sales of close to one million units in 2015. However, as major CE and pro AV display heavyweights enter the market and focus on volume business, value will be driven out of SNB displays putting pressure on the entire video wall category.

“China and the United States will continue to lead the market, but India, Russia and Brazil will be the ones to watch, becoming increasingly important over the next three years.”

Futuresource Conferences @ CEATEC JAPAN 2012 are planned as below.

Wednesday 3rd October 2012 [Room 201A]

(English with Japanese simultaneous interpretation)

- [IB-07A] 14:00 – 15:00 Global Consumer Electronics Industry Outlook

- Who will benefit from this session:

- Manufacturers, Vendors, retailers and distributors, and associated component suppliers and associations from the following industries:

・ Consumer AV Electronics; Imaging; Computer (including Tablet); Mobile communications; Games Industry

- Entertainment content owners, software and platform operators and media companies will benefit from this presentation.

- [IB-08A] 15:30 – 16:30 The Education Sector – The Next Big Opportunity For the CE Industry?

- Who will benefit from this session:

- Manufacturers, vendors, retailers and distributors, and associated component suppliers and associations from the following industries:

・ Education specialist providers, Display providers, Consumer Electronics; Computer (including Tablet); Mobile communications; Games Industry

- Also content owners, software and platform operators, and media companies in general will benefit from this presentation.