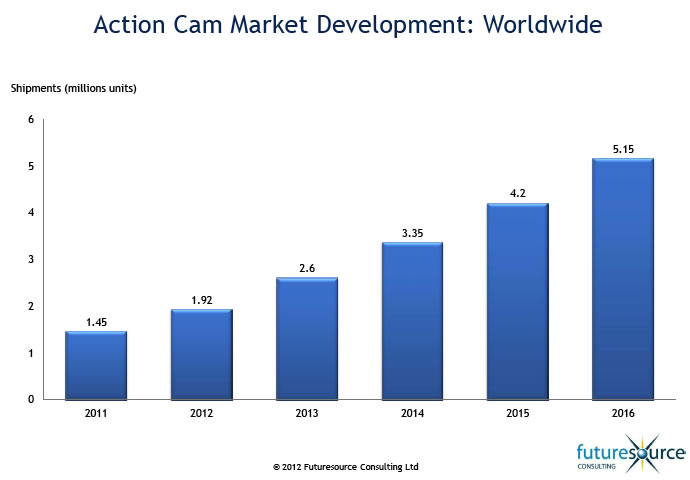

In 2011, the action cam market achieved 24% growth, reaching nearly 1.5 million units shipped, according to a new report from Futuresource Consulting. The market has been driven primarily by the US, accounting for 55% of worldwide sales in 2011. The market is on track to achieve nearly two million units shipped in 2012 and anticipating even greater growth by 2016, with the market more than doubling to exceed five million units, representing a total retail value of almost $1.7 billion.

Having been viewed traditionally as a niche market, demand is driven by extreme sports enthusiasts as the devices possess a unique range of features, including remote functionality, mount capability and rugged, waterproof design. More recently, social networking, powered by integrated Wi-Fi and the inclusion of Bluetooth, has become a key driver, encouraging a move towards wider groups, including keen travellers.

Unlike the traditional consumer camcorder market, action cam growth will remain resilient to the threat of convergence and video-enabled phones, due to the specialist functions and capabilities associated with the devices. The market is forecast to witness over 37% CAGR between 2012 and 2016 as these specialist devices begin to appeal to a wider audience.

In terms of key brands, GoPro has cemented its position as the dominant player, followed by Contour and Drift. However, in recent months traditional CE brands, such as Sony and JVC, have entered the market in a bid to diversify from ailing traditional camcorder devices.

As more devices come to market, and user-groups develop, average retail prices are expected to decline by 19% between 2012 and 2016, to around $304. Bundling devices with mounts and other accessories has been a key driver in recent years, with bundles which have been tailored to a specific sport or activity performing particularly well. Hard bundle sales such as these are forecast to become of increasing importance moving forward, accounting for 77% of worldwide sales in 2016.

As the market expands into wider user-groups, channel distribution is rapidly shifting from specialist sports and online retailers to more mainstream CE chains. While this has led to a surge in sales of action cam devices, it has resulted in further declines in the traditional camcorder market. A war for shelf-space is currently being waged between the two categories, with an increasing number of CE retailers now favouring the growing action cam segment, while sales of traditional camcorders fall.

Futuresource Conferences @ CEATEC JAPAN 2012 are planned as below.

Wednesday 3rd October 2012 [Room 201A]

(English with Japanese simultaneous interpretation)

- [IB-07A] 14:00 – 15:00 Global Consumer Electronics Industry Outlook

- Who will benefit from this session:

- Manufacturers, Vendors, retailers and distributors, and associated component suppliers and associations from the following industries:

・ Consumer AV Electronics; Imaging; Computer (including Tablet); Mobile communications; Games Industry

- Entertainment content owners, software and platform operators and media companies will benefit from this presentation.

- [IB-08A] 15:30 – 16:30 The Education Sector – The Next Big Opportunity For the CE Industry?

- Who will benefit from this session:

- Manufacturers, vendors, retailers and distributors, and associated component suppliers and associations from the following industries:

・ Education specialist providers, Display providers, Consumer Electronics; Computer (including Tablet); Mobile communications; Games Industry

- Also content owners, software and platform operators, and media companies in general will benefit from this presentation.