The global* pro camcorder market remained stable in 2013 with a decrease of less than 1% from the previous year, to reach 289,000 units in total, according to newly released figures from Futuresource Consulting. However, the end of year data shows that the stability of the overall market hides very different regional pictures.

Transition Period is Ending

“The transitions to HD and non-tape are coming to an end in the more mature markets such as Europe and North America and volumes have tailed off accordingly as end users no longer have a compelling reason to go out and replace their existing camcorders, especially in the current financial climate,” says Adam Cox, Head of Broadcast Equipment, Futuresource Consulting. “Though the continued decrease in the prices of professional camcorders means that more people are able to enter the world of professional video, increasing the addressable market for pro camcorder vendors. These new entrants often do not have the same predilection for professional camcorders, though and so traditional camcorders are facing stiff competition from video-capable DSLRs.”

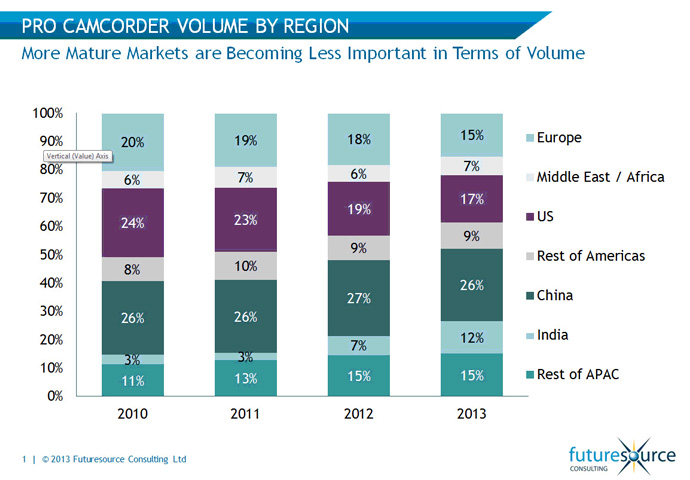

This has led to a 15% decrease in volume in 2013 in Europe and a 12% decline in the North America. These markets are expected to remain in a similar state until demand for 4K really starts in take off in a couple of years’ time. Although affordable 4K products are now starting to enter the market, interest remains at a low level and it will need a number of high-profile broadcasters to lead the way before the technology really starts to drive these markets forward.

Emerging Markets

In emerging markets such as APAC, South America and Middle East Africa the pro camcorder markets have grown significantly as a combination of factors fuelled demand. In many countries, the broadcast and pay-TV industries are in their early stages and as these expand, investment is pouring into new equipment. At the same time, the upgrade to HD and non-tape workflows are continuing in earnest, further encouraging end users to invest. Another significant factor is the growing affluent middle class in the region and particularly in China and India, with low end, sub $2,500 camcorder volumes, popular in event videography and similar production types, growing by 39% in the region year on year.

Overall, South American volumes grew by 22%, Middle Eastern/African volumes increased by 8% and the already considerable APAC volumes increased by 7% in 2013 meaning that APAC accounted for over half of all pro camcorder volumes in 2013.

“The outlook for 2014 is more positive than 2013 with continued growth expected in emerging markets and the more mature markets rallying as new products cause excitement and the replacement market picks up,” says Cox. “However, significant growth is not expected in Europe or North America for a number of years.”