The global pro camcorder market enjoyed a buoyant first half of 2014 with an overall increase of 5% (7,000 units) from H1 2013 to reach a total of 149,000 units, according to the latest pro camcorder tracking report from Futuresource Consulting.

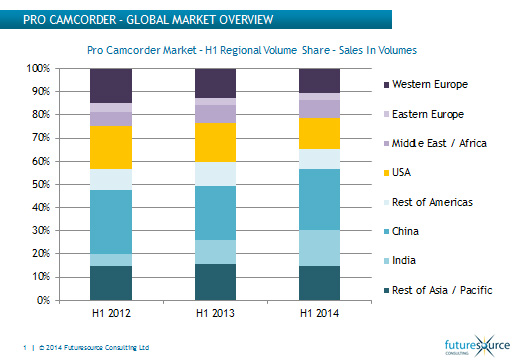

However, at a regional level the picture continues to be mixed. APAC remains the powerhouse for growth, with India experiencing particularly large volume growth between H1 2013 and the first half of 2014.

“Indian volumes were up by 58% (almost 9,000 units) over this time period, as the digital revolution continues to take hold and extremely low cost prosumer products satisfy the soaring demand for entry level professional products, particularly within the wedding and events markets,” says Adam Cox, Head of Broadcast Equipment, Futuresource Consulting.

Despite the significant growth, India is still dwarfed by the Chinese market, which accounted for over a quarter of global shipments in H1 2014.

“For mature markets such as the US, Western Europe – and parts of APAC such as South Korea – the story is very different,” says Cox. “In many cases these markets are largely saturated, competition from non-traditional acquisition devices is taking its toll and HD and non-tape transitions are all but complete – it is only the very late adopters who have yet to upgrade.

“This is true even if end users aren’t planning to shoot in HD at the moment. Globally, 91% of pro camcorders shipped in H1 2014 were HD/SD switchable – only 1% were SD only – with huge numbers of end users having no intention of shooting in HD now, but instead future-proofing their purchases.”

A similar scenario is playing out for 4K. 4K camcorders accounted for 1% of volumes in H1 2014, but this will grow relatively quickly despite demand for 4K content being extremely minimal outside of high-end production. The question for end users is not ‘do you want to shoot in 4K now?’, but rather ‘do you want to shoot in 4K within the next five years?’. In principle, adoption of 4K pro camcorders could start to ramp up comparatively quickly, but this is dependent on the products launched by vendors and, perhaps most importantly, their price points.

Futuresource research shows that the global average selling price of pro camcorders has dropped by almost $2,000 from 2013, to reach just under $4,000 in H1 2014. Ordinarily a new technology would command a price premium for a considerable time, but with pressures on pricing mounting, particularly with regard to the fending off of the DSLR threat, prices could come down more rapidly than in previous cases.

“4K really needs to take off before the mature markets will return to states of growth, but until then the global market will retain its split between emerging and mature markets,” says Cox.